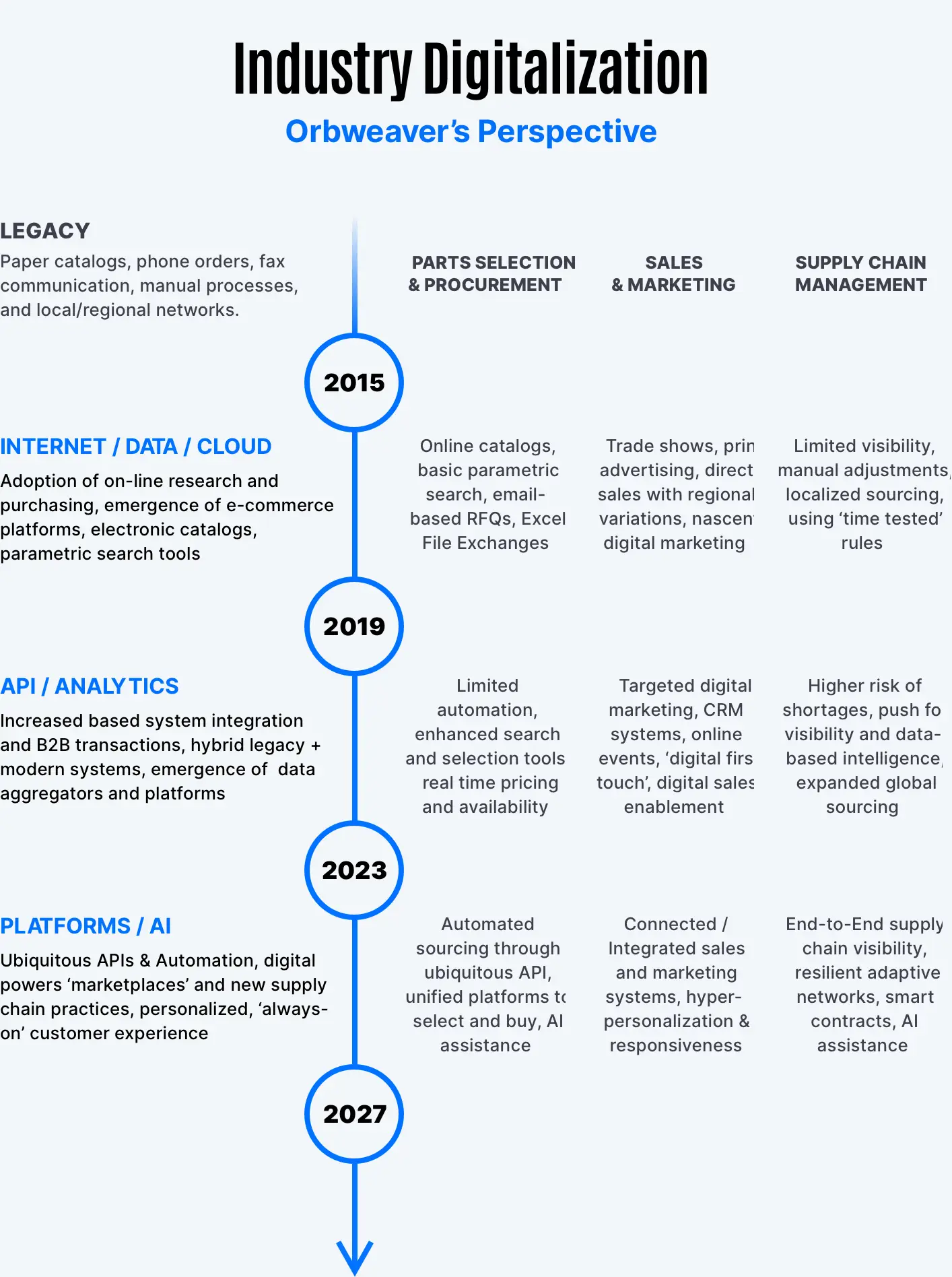

Shifting Paradigms: A Timeline Of Digital Transformation In The Electronics Industry

As a leading provider of data and procurement automation solutions for the electronics industry since 2012, Orbweaver has developed a unique perspective on this transformation. This article will examine five critical periods of digitalization in the industry and discuss our short- and long-term views.

Before 2000: The Analog Age

The electronics industry has experienced a remarkable evolution from its early days of analog technologies. Before the turn of the century, the industry relied heavily on conventional supply chain management methods, with paper catalogs, offline databases, and multiple paper-based resources being the primary sources of product information. Consequently, essential data was often fragmented and needed to be more frequently updated. The collaboration between stakeholders was limited, and response times to changes in demand or supply were often insufficient.

In the late 1990s, the electronics industry started taking firm steps toward digitalization. For example, as highlighted in the ECIA 100-Year Commemorative EBook – Electronic Component Industry Evolution, in 1995 Allied Electronics recognized the benefits of digitizing its product catalogs and launched the first-ever catalog on a CD-ROM. The innovation allowed faster-than-ever distribution sharing and access to product information.

Customer Relationship Management (CRM) systems gained ground in the industry. Progressive companies saw the potential of CRM systems in streamlining sales processes, overseeing customer interactions, and improving overall efficiency.

Another significant event was the launch of Amazon in 1994. Although Amazon initially focused on selling books, its trailblazing e-commerce platform would later change how businesses and consumers bought products, laying the foundation for the future of digital transformation in both B2C and B2B realms.

Despite these initial steps toward digitalization, the electronics industry still relied on conventional communication and transaction methods. Phones, faxes, and emails were (and in some cases, still are) used for everyday business. However, times were changing, and the electronics industry was taking the first steps toward a digital revolution with the new millennium approaching.

The Early 2000s: The Dawn of Digitalization

The early 2000s signified a crucial period in the digital transformation of the electronics industry. As the global market for electronic component distribution reached a staggering $150 billion in 2005 (EETimes, 2006), businesses began to adopt digital technologies to optimize procurement and other supply chain processes and enhance information sharing. The initial wave of digital innovations during this time laid the groundwork for the industry’s continuing evolution.

In this era, companies started acknowledging the benefits of digital tools for streamlining procurement and improving efficiency. The Internet significantly enabled better communication and information exchange among suppliers, distributors, and customers. The emergence of electronic component databases and online marketplaces facilitated faster access to product details, making it easier for businesses to identify and source the components they needed.

Despite these advancements, early digitalization efforts were often fragmented, with many companies using a combination of disconnected systems and platforms. This lack of integration resulted in data silos and limited collaboration, preventing the industry from fully realizing the potential of digital technologies.

To overcome these challenges, businesses began investing in digital solutions to unify their procurement processes and promote seamless information sharing. For example, Electronic Data Interchange (EDI) grew in popularity because it allowed businesses to automate transactions and standardize data exchange between trading partners.

During this time, websites tailored to the electronics industry, such as those developed by Digi-Key and Mouser Electronics, gained users at an accelerated rate. These platforms provided a location for purchasing electronic components, enabling customers to compare prices and specifications for many components from multiple suppliers.

Furthermore, this period marked the development of digital marketing strategies as companies shifted their focus from conventional sales channels to online platforms. Tactics like email campaigns, search engine optimization (SEO), and social media marketing gained popularity for promoting products and engaging customers digitally.

2010 to 2020: E-Commerce Expansion

The period between 2010 and 2020 resulted in impressive growth in e-commerce in the industry as online marketplaces for electronic components became prevalent and an increasingly sought-after channel. According to a Grand View Research study, the worldwide electronic components market reached an astounding $825.6 billion in 2019, with a larger share of sales taking place online. This expansion was fueled by businesses that capitalized on digital sales channels and marketing tactics, such as social media and email campaigns, to connect with customers more effectively.

During this time, well-established industry players like Arrow Electronics, Avnet, and Digi-Key enhanced their online presence by developing user-friendly platforms and advanced search features. In 2019, Texas Instruments strategically opted to reduce its reliance on distribution and instead offered an extensive list of digital capabilities directly to its customers. This move showed that component manufacturing companies could provide a smooth, efficient experience direct to buyers for sourcing and purchasing electronic components using available digital capabilities.

The importance of sophisticated electronic system design and supply chain management digital tools became crucial for maintaining and evolving business models within the industry. E-commerce, e-stores, and the ability to purchase directly from manufacturers began to dominate the market, further propelling the shift toward online sales channels. New entrants disrupted the market with their innovative digital capabilities and business models, offering new and unique features.

The availability of cost-effective, efficient, and fast data storage, data transfer, and sharing, combined with increasingly sophisticated analytics, has played a significant role in accelerating disruption and generating new opportunities in the industry. Manufacturers and Distributors use readily available digital marketing tools and capabilities to enhance visibility, offer recommendations and attract customers to their platforms.

In addition to these developments in marketing and sales, this period brought digital tools for managing increasingly complex supply chains. Cloud-based software solutions for inventory management, order processing, and supplier relationship management gained popularity, enabling companies to optimize their operations and improve collaboration with supply chain partners.

2020 to 2025: The Rise of Connected Ecosystems

The industry is moving toward API-based platforms, IoT technology, and real-time inventory management solutions. Digitalization becomes a driving force for growth and innovation within the industry, with IoT being widely adopted in manufacturing and electronics production, facilitating end-to-end digital transactions and streamlined supply chains. The Covid pandemic impact was also felt by all players in the electronics industry, expediting the transition to digitalization and connected ecosystems.

During this period, sales and marketing strategies are also substantially evolving, focusing on data-driven and personalized approaches, matching the current generation’s buyer-experience expectations set by Amazon, Instacart, and DoorDash. Integrated sales and marketing platforms are becoming standard practice, allowing businesses to gain a unified view of their customers and suppliers and make informed decisions. Organizations employ advanced analytics and AI-driven tools to develop targeted marketing campaigns, ensuring more effective customer engagement.

The electronics industry is already testing and adopting new business models. New competitors are emerging, driven by the adoption of digital technologies and the potential to disrupt traditional industry structures. These new players are challenging long-held beliefs on how important business processes are executed. Startups and smaller companies are now, more than ever, able to develop and deploy innovative solutions quickly, challenging established players and reshaping the competitive landscape.

Often, these new entrants concentrate on niche markets or specific industry pain points, differentiating themselves through distinctive value propositions and digital-first approaches. The phrase “we have always done it this way…” is no longer evidence of solid execution. The focus is shifting toward building adaptive and transparent supply chain networks capable of responding to market fluctuations and emerging trends. Supply chain management is experiencing further advancements as companies embrace sophisticated analytics and AI-powered tools for optimization. Enhanced visibility and traceability become possible through real-time data sharing between supply chain partners, empowering proactive responses to disruptions and fostering resilience and agility.

The Years After 2025: The Seamless Integration Era

Procurement and supply chain automation enabled by advanced digital capabilities will be instrumental in streamlining electronic systems design, component selection, procurement, and supply chain processes, leading to significant strategic shifts for the industry.

One significant change we see is the widespread adoption of digital procurement platforms that utilize real-time inventory data, analytics, and intelligent decision-making tools to optimize purchasing processes. These platforms will enable component manufacturers, distributors, EMS, and OEM companies to collaborate effectively, make better, data-driven decisions and act on them promptly.

Another critical development will be the implementation of increasingly sophisticated supply chain management solutions that will require clean, reliable data feeds, facilitating improved visibility, traceability, and risk management. Companies will find high-value business use cases for blockchain technology to create transparent and tamper-proof records of their supply chain transactions, resulting in increased trust among stakeholders and better traceability of components.

New platforms will come together and offer unified, frictionless purchasing experiences. Focus, visibility, collaboration, and data sharing among all supply chain partners will be a priority. The new platforms will enable seamless transactions and efficient communication between manufacturers, distributors, and customers, leading to more adaptable business models.

Ultimately, we see frictionless integration with supply chain partners enabled through data integration partners, and future supply chain digitalization will be as easy as scanning a QR Code on the back of a (virtual) business card.

Companies must adapt and innovate to remain competitive in the rapidly changing environment. As the industry accelerates its adoption and use of digital technologies, traditional boundaries between players will blur, giving rise to new business models already growing in other industries today. Component manufacturers, distributors, EMS, and OEM companies must disrupt themselves before new entrants and new technology displace them.

Incumbents must explore partnerships, mergers, and acquisitions to enhance their digital capabilities and protect their position in the industry. Strategic focus will shift toward providing end-to-end solutions and services, covering everything from design and prototyping to production and after-sales supply chain support. Efforts will focus on building a more integrated and efficient ecosystem. By doing so, the electronics industry will transform into a highly connected and agile network where businesses will prosper in the era of seamless integration.